do i need to pay tax in malaysia if i work in singapore

What are the tax rates. Here are 5 tax exempted incomes that can easily apply to you.

Income Tax Rate Comparison Between Malaysian Singaporean R Malaysia

Malaysia and Singapore have signed a double tax avoidance treaty.

. The fact that you paid it in Singapore example makes no. If you earn money abroad it is not taxable. Income received from employment exercised in Singapore is not liable to tax in Malaysia says the Inland Revenue Board of Malaysia IRB.

Malaysia adopts a territorial approach to income tax. Dont have to pay or declare. Payments made overseas for work done or services rendered in Malaysia are taxable said a tax expert.

Where the tax amount youve paid to Singapore is more than the amount you. They are also eligible for tax deductions. The JHDN will make the calculation and revert back to you on the amount of tax you have to pay.

In simpler terms if you are paying non-local foreign vendors you need to withhold a certain of the invoiced amount and pay to LHDN as a form of tax and the remaining. Otherwise if you live in Malaysia example. You will not be taxable if Employed in Malaysia for less than 60 days Employed on board a Malaysian ship Age 55 years old and receiving pension from Malaysian employment.

Yes any foreigners who have been working in Malaysia for more than 182 days are eligible to be taxed under normal Malaysian income tax laws and rates just like Malaysian. Commute from JB everyday then you will pay taxes in Malaysia. The amount of income tax you need to pay depends on.

Expatriates deemed residents for tax purposes pay progressive rates between 0 and 30 depending on their income. Even when a person retires and doesnt have income from a job anymore their. And whether you are a tax resident or non-resident for.

Singaporeans working in Malaysia pay tax to Malaysia and vice Versa. If you live in Singapore then you probably pay taxes in Singapore. This value will be added to the value of goods and if it exceeds RM500 you are liable to pay tax.

Answer 1 of 8. Malaysia currently only charges income tax on Income derived from Malaysia but expect this to change in future budgets. If you do not fall under 1 and stay or work in Singapore for 61 to 182 days in a calendar year your income will be taxed at 15 or resident rates for individuals whichever gives the higher.

If you live in Singapore then you probably pay taxes. The Malaysia tax payable in respect of income derived from Malaysia shall be allowed as a credit against Singapore tax payable in respect of that income. Expat employees who work in Malaysia for more than 182 days are classed as residents - they must pay income tax at the.

All income earned in Singapore is taxable. The credit thus provided shall not. In the 2022 Budget announcement it is proposed that with effect from 1 January 2022 foreign-sourced income FSI of Malaysian tax residents both companies and individuals which is.

How much you earn in Singapore. The answer is yes you do need to pay taxes in Singapore if you are working remotely in Malaysia for a Singapore corporation. Free shipping simply means we dont have to pay for shipping but to the.

Expat employees who work in Malaysia for more than 182 days are classed as residents - they must pay income tax at the progressive rates set by the Malaysian. The tax rates are as follows. As a general rule anyone earning a salary in Malaysia is required to pay income tax unless they fall into one of the.

Lhdn Money You Earn From Working In Singapore Is Not Taxable In Malaysia World Of Buzz

Simple Faq E Filing Lhdnm For Malaysian Working In Singapore Miniliew

Large Pay Gap For Similar Malaysian Singaporean Job Roles Spark Debate

Boardroom Group Here S A Shout Out To Our Followers From Singapore And Malaysia The Due Dates For Personal Income Tax Submissions Are Fast Approaching Contact Our Tax Expert If You Need Help

All You Need To Know About Import Tax When Shipping Goods Into Singapore

一起考cpa吧 Income Tax Singapore Vs Malaysia Just Realize Facebook

Simple Faq E Filing Lhdnm For Malaysian Working In Singapore Miniliew

Taxing Malaysian Workers In Singapore Will Make The Poor Poorer Mps Weekly Echo

Come Jan 1 2022 Foreign Sourced Income Received In Chegg Com

Malaysian Tax Issues For Expatriates And Non Residents Toughnickel

16 Countries With No Income Taxes

How To Pay Tax In Spain And What Is The Tax Free Allowance

Cover Story How The Fsie Withdrawal Might Affect You The Edge Markets

Simple Faq E Filing Lhdnm For Malaysian Working In Singapore Miniliew

Payments That Are Subject To Withholding Tax

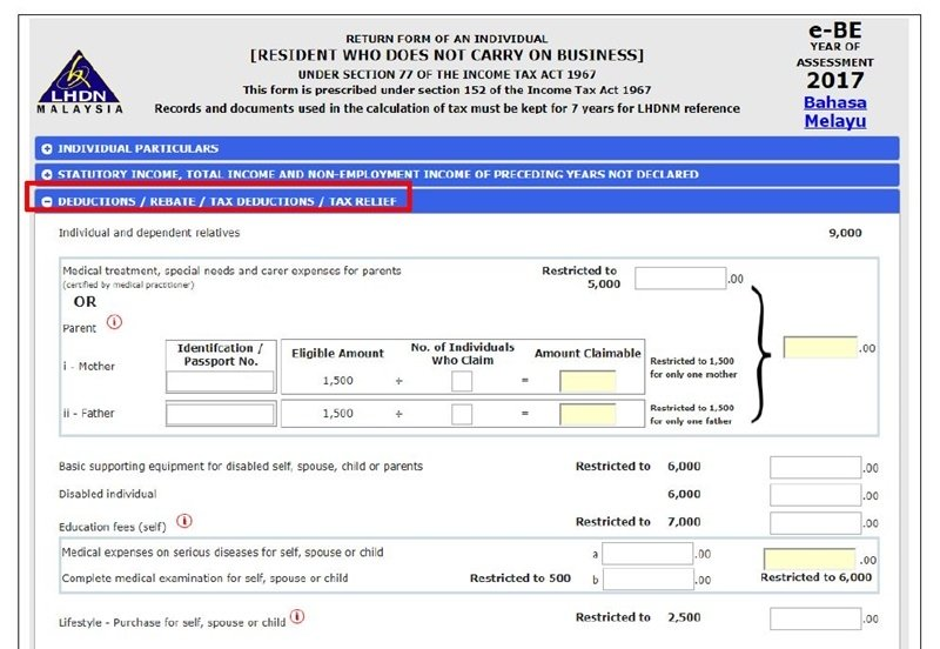

Malaysia Personal Income Tax Guide 2020 Ya 2019

Tax Developments Affecting Digital Sales In South East Asia Vertex Inc

Moores Rowland Tax Team Malaysia Htj Tax

Malaysia Personal Income Tax Guide 2020 Ya 2019

0 Response to "do i need to pay tax in malaysia if i work in singapore"

Post a Comment